Visa is rolling three older rulebooks (VDMP, VFMP, and the first version of VAMP) into one stronger Visa Acquirer Monitoring Program. The new VAMP tracks fraud, disputes, and card-testing attacks with a single score. This shift means every merchant, acquirer, and ISO in the payment chain will need to act faster and smarter to stay in compliance and avoid new penalties.

Why VAMP Matters to Merchants and ISOs

For merchants (businesses that accept payments) and Independent Sales Organizations (ISOs), the VAMP update changes how you handle payments, how much fraud risk you carry, and how much you pay in fees. High fraud alerts, friendly-fraud chargebacks, or bot testing can push the ratio above Visa’s limits. Knowing the thresholds and acting early helps keep your business protected and compliant, and your costs under control.

Key Dates You Must Know

April 1, 2025 – Advisory period starts.

June 1, 2025 – New thresholds go live.

September 30, 2025- Program Advisory period ends.

October 1, 2025 – Fines for “Excessive” merchants and acquirers start.

January 1, 2026 – Fines for “Above Standard” acquirers start.

April 1, 2026– Merchant Excessive threshold lowers to >150bps in key regions (US, EU, AP, CA)

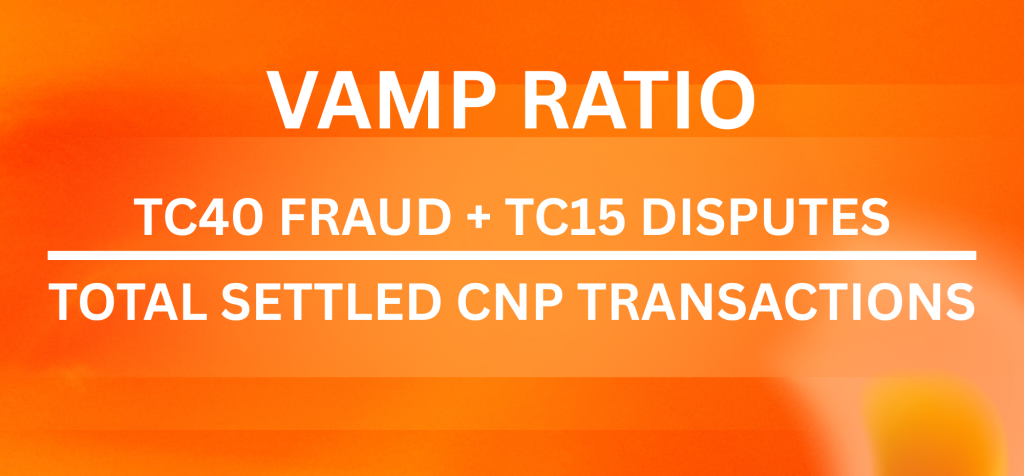

VAMP Ratio Calculation for Disputes, Chargebacks, and Fraud Reports

VAMP Ratio= (Reported Fraudulent Transactions + Total Disputes) / Total Settled CNP Transactions

Where:

TC40 = Count of Visa fraud reports (fraudulent transactions reported by issuers) received for your portfolio in a given month.

TC15 = Count of Visa disputes/chargebacks (non-fraud related as well) for the same period.

Total Settled CNP Transactions (TC05) = Total number of card-not-present (CNP) settled transactions for the same month. Get the count of all settled CNP transactions (sales, not just authorizations) EXCLUDING all card-present transactions.

Multiply by 100 to view it as a percent. (optional, since Visa thresholds are in %)

Why One Bad Sale Can Count Twice

This new VAMP Ratio specifically applies to Card-Not-Present (CNP) transactions only. Keep in mind that one fraud sale can show up twice in the VAMP score. When a transaction first hits Visa’s Early Fraud Warning (TC40) and later turns into a chargeback (TC15), Visa adds both to the numerator of the VAMP ratio.

For instance, a merchant with 80 fraud reports (40 of which becomes a chargeback dispute) and 10 non-fraud disputes out of 10,000 transactions, which previously resulted in a 0.9% ratio, would now see a 1.3% ratio under VAMP due to this double-counting. This “double-counting” effect can significantly inflate a merchant’s VAMP ratio even if the absolute number of fraudulent events remains constant. Merchants need to grasp this shift, review how they track disputes and fraud, and tighten reporting or they may face unexpected fees.

Thresholds for acquirers and merchants

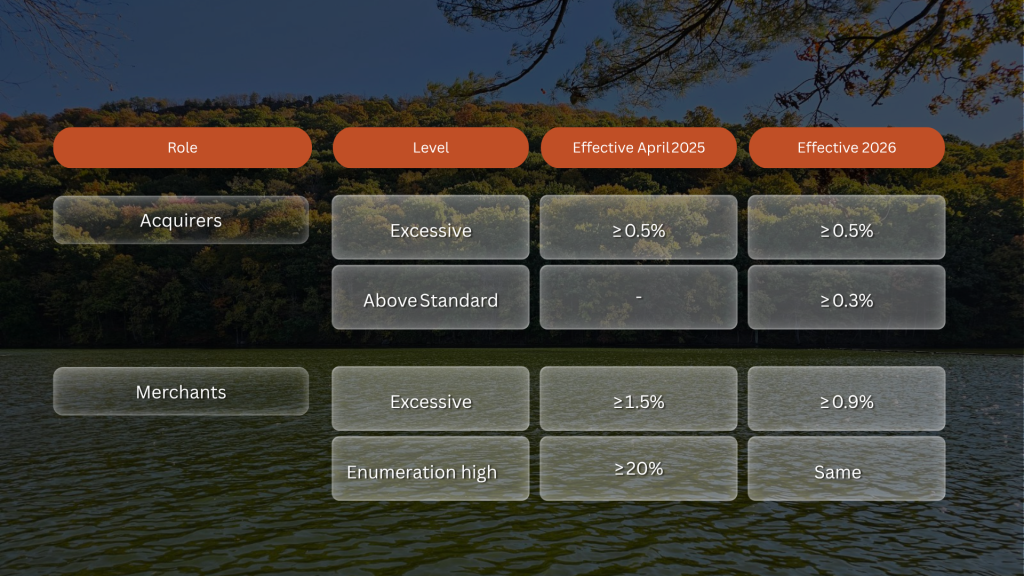

Visa reviews each portfolio monthly, tracking fraud, disputes, and enumeration activity against VAMP thresholds. If an acquirer or merchant exceeds those limits, they’re flagged for action.

For Merchants, there’s no middle ground or early warning stage since Visa has removed the “above standard” stage, meaning penalties apply immediately once they exceed the limits. The “Excessive” threshold starts at ≥ 1.5 percent in 2025 but tightens to 0.9 percent effective year 2026. The “Enumeration High” category remains unchanged, flagging any merchant whose card‑testing activity is 20 percent or higher in both years.

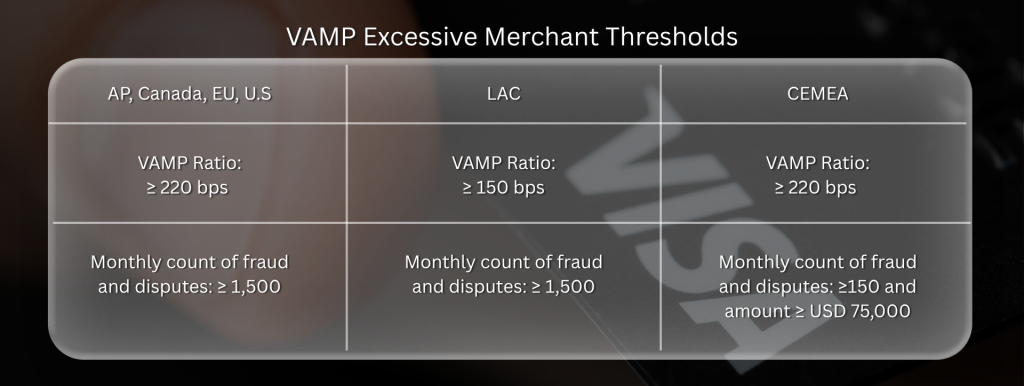

For acquirers, however, the multi-tiered enrollment structure remains. Beginning in April 2025, Visa will mark an acquirer as “Excessive” once its VAMP ratio reaches 0.5 percent or more, and this cutoff stays the same for 2026. A new “Above Standard” tier comes into play in 2026 when their ratio is at least 0.3 percent. If acquirer is not Above Standard or Excessive, then the following Excessive Merchant performance thresholds apply:

Enumeration ratio: 2,000 bps (20 %) or higher

Enumeration transactions: 300,000 or more in one month

How to Prepare for VAMP

Staying ahead of the new VAMP rules starts with knowing your numbers. Start with your data: pull complete TC40 and TC15 records from your PSP or gateway so you know exactly where fraud and disputes stand. Layer in pre-dispute tools and real-time fraud filters, and fine-tune your own operations—double-check shipping accuracy, give customers easy self-service options, and use clear billing descriptors that head off friendly fraud. Keep an open line with your acquirer, comparing your ratios to their portfolio-level targets and agreeing on how you’ll both track issues.

Here’s how to get your team ready:

Pull your numbers weekly: Track TC40, TC15, TC05, and enumeration metrics. Don’t wait for month-end reports.

Fix billing descriptors: Make sure your descriptor is easy to recognize to reduce “I don’t recognize this” disputes.

Use fraud tools early: Turn on 3-D Secure, velocity filters, device fingerprinting, and IP monitoring.

Close disputes fast: Use RDR, Order Insight, and Compelling Evidence 3.0 to resolve issues before they count.

Educate your merchants: ISOs and acquirers should keep partners informed and supported with clear data and action steps.

Plan for penalties: Build a reserve if you’re getting close to the threshold—don’t let it catch you off guard.

Need help reviewing your current risk scores or building a VAMP readiness plan?

Connect with our team—we’ll walk you through your next steps and make sure you’re ready before enforcement begins.