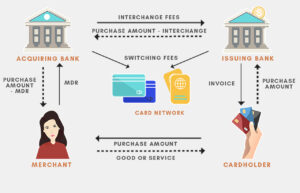

Interchange is a collection of fees that a merchant is required to pay with every credit card and debit card transaction.

Interchange, sometimes referred to as “swipe fees,” are what financial companies charge for accepting the credit risk and handling charges in credit card transactions. Many things can affect the fee amount, and it can be difficult to determine how much the charges will be without looking at an official number from companies. We will talk about a few of these variables below and make sure you know how to get the best rate for yourself and your business.

Paying fees is not fun.

No one wants to if they can avoid it, but it actually serves a valid purpose in the credit card industry. Companies who process credit card payments take on a certain level of risk. They are moving money around before the money is actually available to them. The higher the risk of the transaction, the higher the fees associated with payment. For example, in our previous article on processing terms, we mentioned keyed-in payments carry much larger risk to a company than swiped cards. This is because it is assumed that the card is not present at the time of the transaction, even if it actually was simply a malfunction. Anyone can claim fraud on a transaction like that and there is far less evidence to the contrary as opposed to swiped cards with pin/signature confirmation. Swiped cards now sometimes even carry more fees than chip read cards, as those have been determined to carry even less security risk than swiped cards.

Card processing comes with three main fees:

Acquirer markup: Charged by the acquirer for acquiring the funds from your shopper

Card scheme fees: Charged by the card scheme for using its network

Interchange fee: Charged by the cardholder’s bank

Of these, interchange fees make up the most significant chunk of card processing fees. You can control or influence some of these factors, but not all of them. Even this summation is somewhat oversimplified, since there are actually about 300 individual interchange fees composing the single interchange fee you actually pay.

Processing Method:

The terms card-present and card-not-present refer to the different ways of processing a credit card transaction. Card-present interchange categories carry smaller fees than card-not-present categories. If it’s possible to swipe cards, that will help you keep fees down.

Card-Presence:

Card-present transactions are those where a merchant is able to read a customer’s credit card data electronically. This process is referred to as electronic capture. This includes swiping a magnetic stripe card, an EMV chip card, or tapping a contactless payment card, such as Apple Pay or Samsung Pay.

On the other hand, card not present transactions are those where the cardholder enters their card details online (such as through an ecommerce checkout page or an invoice page) or where you enter the card details manually into a credit card machine or online portal.

Transaction Data:

Proper and complete transaction data is especially important for businesses that process card-not-present transactions and for those that deal with corporate and government cards.

Interchange qualification factors that you can’t control include:

Merchant Code:

Specific interchange categories exist for businesses that fall under certain merchant category code (MCC) designations. However, you’re not able to control or change your MCC just to change your interchange qualification. MCCs are assigned based on the type of business that you run.

Card Type & Brand:

Separate interchange categories exist for credit and debit card charges, and for specific types of cards within those classes. For example, rewards credit cards will have different rates than non-rewards credit cards. Additionally, the brand of a card will impact interchange qualification. Visa has different rates than Mastercard. However, you’re not in control of what type of card your customer uses.

Card Owner

Corporate and government credit cards have their own interchange categories separate from consumer credit cards. Additionally, if a customer uses a rewards card to pay, the interchange fees are also generally higher. This is because the increased fees pay for the extras offered by rewards programs.

Sometimes, depending on your processor and company policy, interchange can instead be a flat rate fee structure. Aggregators, (someone or something that gathers together materials from a variety of sources; especially websites) like PayPal, Stripe, and Square charge a flat fee of 2.95%. You pay the same fees on any type of card that is swiped. That doesn’t mean they can’t/don’t also charge fees on top of that. For instance, to process payments through Stripe, you may pay 2.9% + $0.30 for each card swiped. Most of these higher cost processors are used for the convenience of being able to have everything tied together conveniently online, and the well known names, but it will cost a premium.

Basis points.

They sound complicated, but don’t worry, it’s simpler than it looks.

Basis points are a common unit of measure for interest rates. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001.

1% change = 100 basis points & 0.01% = 1 basis point.

The reason most in processing and finance use the term basis point is because it’s more convenient than referring to the percentage number and can also help avoid ambiguity with a client. This can help expedite communications and avoid trading mistakes.

For example, the Mastercard credit card processing interchange fee for a swiped card is currently 1.58% + $0.10 and comes with a small authorization fee. (The $0.10 is a transaction fee from the bank or credit card provider.) Using basis basis points, this would be simply 158 BPS.

Interchange is something you can’t change.

It is simply part of the cost of doing business, however, there can be a catch. Some credit card processors “pad” interchange, adding on to Visa’s and Mastercard’s published interchange rates without telling you, calling it all “interchange fees” rolled up into one.

If your processor does this, you’re paying more than you have to and may not even realize it. What’s even worse is that padded interchange is difficult to spot unless you’re familiar with exact interchange costs. In most places, there are very few regulations in credit card processing. Hidden charges within interchange is not illegal, but by being informed and sticking with a reputable processor you can avoid most issues. Interchange fees for the two largest card brands may change twice annually, in April and October, so that isn’t an issue of charging extra fees, it may just simply go up with time.

A common misconception is that interchange fees change or increase simply for the banks/card issuers to make more profit. Interchange fees are driven by the banks’ need to recover losses they experience for processing credit card transactions.

The banking industry is a complex environment that is constantly in motion. Interchange rates for merchants who accept electronic payments from cards can become less or more risky depending on the financial climate.

In the United States, there is no cap on interchange fees for credit card payments, but the Durbin Amendment caps interchange fees on debit card payments at $0.22 per transaction and five basis points multiplied by the value of the transaction but only if the bank issuing the card has over a set assets limit. We could get even further into the weeds of the interchange fees around the world, but keeping it simple, they’re non-negotiable, and at least in the USA, not regulated.

If you’re not 100% satisfied with your interchange rates, you should consider switching to another provider. By implementing an integrated payments solution, merchants can accept payments through a variety of methods using the same, consolidated system. Another method of choice may be a cash discount or surcharge program. Turnkey can provide either of those types of programs, but be sure to check your state laws or ask a sales rep about if surcharging is legal in your state. Previously, many states prohibited surcharging. As of the writing of this article however, there are only a handful.

Cash Discount/Surcharging:

One way of saving on interchange fees is surcharging, which is simply the addition of the fee you would normally pay on top of a clients purchase price. This in theory covers the cost of your processing, and passes on the interchange fees to the customer. Only you know how your customers would react to an added fee as well as how much that fee should be. But be weary, you can only surcharge credit cards. You cannot surcharge debit cards, including debit “run as credit.” This is an important consideration. If your customer base utilizes debit cards more than credit cards, surcharging might not be the best solution.

Another solution might be cash discount programs. Which may sound rather similar to surcharging, but with one main difference. Instead of having customers pay a fee for credit use, you have a discount available for customers paying cash. This positive mentality usually goes over better with customers. Less of a “fee”, and more of a perk. This also covers your processing fees through those who choose to pay a higher price for the convenience of paying with a card. Turnkey provides both of these types of programs depending on your state and business type.

In The End

Overall, interchange seems daunting when you first look into it. Multiple components and ever-changing rates. But, if you boil down your research to one simple goal, you are probably just looking for the best prices for your business. That’s why we look into the best practices and prices available for our customers so they don’t have to spend all day looking into location specific rules and regulations.

Prices are always fluctuating and it truly depends on what your business needs. Even though it may not technically be optimal, it is very possible your business may need the option to key in credit cards, and if that’s the case we will work to make sure you get the best service available. We are flexible for your business.

Contact us today if you have any questions or want to discuss how Turnkey can get started helping you process efficiently.